On 10 Sep 2018, the Singapore Parliament debated on Land Transport (Enforcement Measures) Bill. Some of the members of Parliament called for third-party liability insurance for riders to be made mandatory.

“An accident is an experience that could be very traumatising for those involved, (and) issues like compensation and civil lawsuits can further complicate the situation.”

– Mr Zainal Sapari, MP for Pasir Ris-Punggol GRC

The Active Mobility Advisory Panel explained in their report submitted to the Ministry of Transport that the authorities should focus on upstream accident prevention rather imposing mandatory insurance. They felt that such a measure would impose unnecessary burden on the diversify PMD users and reduce the update of active mobility.

The government agreed with their recommendations and decided that the purchase of such insurance should remain voluntary for the time being. Nevertheless, the government and Land Transport Authority (LTA) strongly encouraged e-scooter users to purchase personal liability insurance.

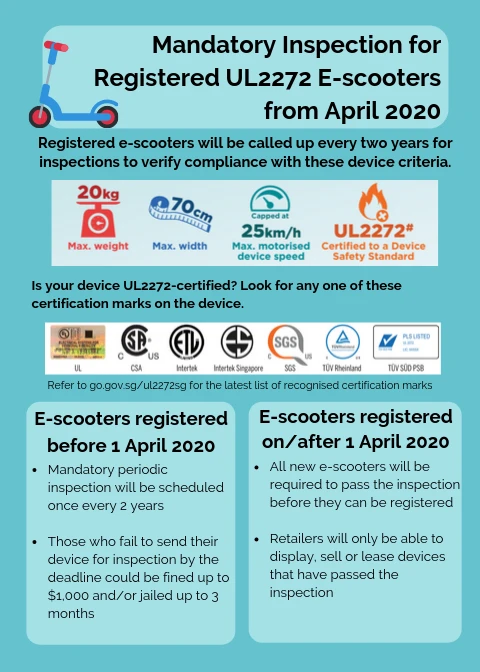

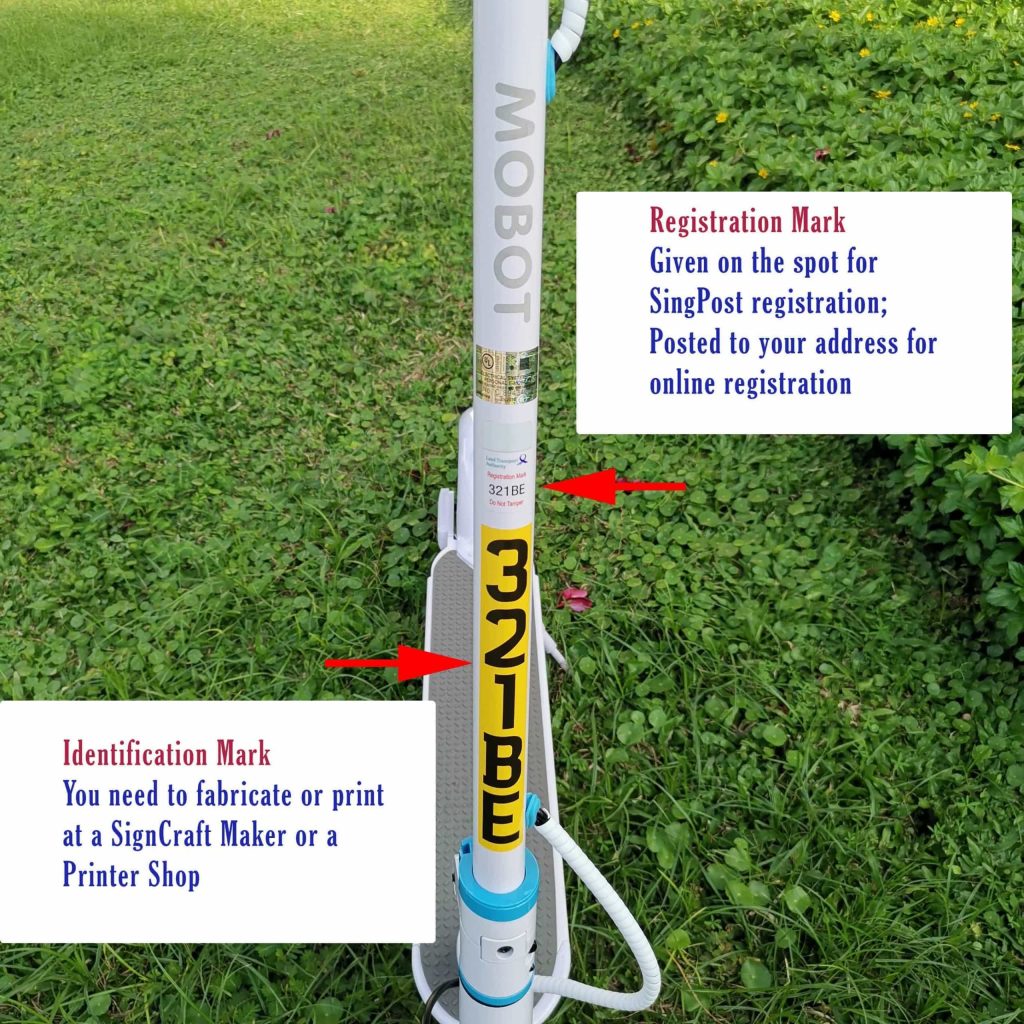

So if you recently purchased a LTA compliant and UL2272 certified e-scooter like the MOBOT L1-1 or Ninebot by Segway ES2, should you buy an e-scooter insurance?

Why should you buy an insurance?

Firstly, if you are injured and require medical treatment, it can cover part of the medical expenses.

Secondly, if you are permanently disabled or suffer life-threatening injuries, it will leave financial support for your family.

Finally, if you are sued for the injuries caused or damages to their property, it will pay for the legal costs and the amount the court awarded to the other party.

What are your options?

Personal Accident (PA) insurance

This is a general insurance where the insurer will pay out the coverage in an unfortunate accident. The payout usually covers medical expenses (reimbursement basis) and death / total permanent disability (lump sum). The geographic coverage is usually worldwide. Some of the insurers will provide limited personal liability coverage.

E-scooter insurance

This insurance is specifically designed for personal mobility devices (PMD) users such as e-scooters, e-bikes and conventional bicycles. It provides payout when the user is mounting, dismounting and riding the e-scooter. The payout usually covers medical expenses (reimbursement basis), death / total permanent disability (lump sum) and personal liability (legal fees and sum awarded by the court).

As of 26 Mar 2019, there are 4 insurers providing such insurance:

NTUC INCOME Personal Mobility Guard (PMG)

They were the first to launch a PMD / e-scooter insurance plan on 20 Apr 2016. They provide the highest personal liability coverage of $1 million.

[table id=2 responsive=scroll /]

eTiQa eProtect Personal Mobility

They are the only insurer that allows users to be covered for less than 12 months. We find this insurance catered more for bicycle users as it provides various optional add-ons which are not applicable to e-scooter. For example, as a bicycle user, you can opt to extend your geographic coverage to outside of Singapore. You can even opt to cover the damage or loss of your bicycle.

[table id=3 responsive=scroll /]

AXA Personal Mobility Protect

This is a balanced plan with comparable coverage and premiums. But it has an excess of $500 for personal liability claims.

[table id=4 responsive=scroll /]

AUTOMOBILE ASSOCIATION OF SINGAPORE’s AA Personal Mobility Plus

This is the cheapest insurance you can buy. But it also provides the least coverage. Nevertheless, we find their complimentary PMD & Bicycle Safety Course a well intention gift to encourage safe riding habits.

[table id=1 responsive=scroll /]

If you already have a PA, do you still need this?

All 4 plans provide similar coverage as with a Personal Accident (PA) plan. They cover these 3 situations:

1. Death (D) or total permanent disability (TPD)

2. Medical expenses

3. Personal liability / Third Party damages

Therefore, you may wonder why should you purchase an e-scooter insurance when you already have a personal accident plan (PA), Medishield and private integrated health plans. Indeed, the above 3 insurance policies already cover much of your medical expenses in an unfortunate accident. And in some policies, it also covers death, total permanent disabilities and third-party liability.

In addition, it may not benefit you significantly since medical expenses claim works on a reimbursement basis. Therefore, if you already have a PA, you may not necessarily need an e-scooter specified insurance plan. You can consider to increase the coverage of your PA instead.

However, if your PA plan specifically mentioned that you will not be covered when the incident occurs during riding, mounting or dismounting of an e-scooter, you may wish to purchase an e-scooter specified insurance.

Scenario: Personal liability – damaging or causing loss to someone else’s property

You were riding on the pedestrian pathway at 10km/h. When riding across the drain grille, the e-scooter rear wheel skidded. You lost control and knocked against a parked car. You also sprain your ankle and had a deep cut on your left thigh.

The car owner sued you for damages.

The insurer will pay, up to the policy limits,:

1. the legal costs and expenses for representing or defending you

2. the amount awarded against you by the court

3. medical expenses, subjected to excess

Then what is the purpose of an e-scooter insurance?

Up till this point, we discuss about coverage for our injuries and to some extent minor payment to the other party injures or property damage.

But what if we look at e-scooter insurance as making sure “we have enough to compensate the other party” in the event of an unfortunate accident where the other party is injured very badly.

Though it is not a deliberate act, you still hope that you can compensate the other party to the fullest. But there are times where the compensation is way beyond your ability.

That is where the e-scooter insurance such as INCOME PMG comes in. For example, INCOME PMG covers up to $1 million third party liability at $96 a year. Currently, we cannot find any PA that can provide similar coverage at that premium.

In other words, we are assured that the other party can receive reasonable compensation as awarded by the court.

Scenario: Personal liability – when injuring another person

You were riding your e-scooter on a cycling path at 15 km/h. There were no pedestrians in front but there was a group of kids playing soccer on a field beside the track. Suddenly, the ball flew onto the track into your path and one of the kids ran out to take the ball. You pressed hard on the brakes but could not stop in time and hit the kid. You fell forward and your head hit the ground. And you were permanent disabled.The kid’s parent sued you for medical expenses and legal fees.

The insurer will pay, up to the policy limits,:

1. the legal costs and expenses for representing or defending you

2. the amount awarded against you by the court

3. the insured sum for TPD

Nevertheless, like any other insurances, there are situations or conditions where the insurer may not cover. Some of these are:

1. When incident occurs outside Singapore

2. When you do not follow the law

3. You are under the effect or influence of alcohol or drugs

4. The incident occurs during a competition

5. You are using the e-scooter for work

6. When it is a deliberate act

7. Does not cover pillion

8. Does not cover when your e-scooter is modified and/or non-compliant

Both PA and e-scooter insurance do not cover theft and fire of e-scooters. Therefore you will not able to claim if your e-scooter is stolen or caught fire due to poor maintenance or illegal modifications.

In our opinion,

If you are using e-scooter (example: FIIDO) or e-bike (example: MINI 16”) to deliver food, you may be better off getting a PA with higher coverage. This is because all the insurers do not cover when the e-scooter is used for commercial or employment reasons.

Similarly, if you are a parent using e-scooter (example: EV 2019) to fetch your kids to school, you should first consider to purchase PA for your kid. All the e-scooter insurance insurers cover the rider but not the pillion.

On the other hand, if you are a frequent e-scooter commuter or weekend long distance leisure rider, you can consider purchasing an e-scooter insurance because of the high third-party liability coverage.

Finally, if you are using a mobility scooter or motorised electric wheelchair, it may be more beneficial to purchase a PA instead. This is because these Personal Mobility Aids (PMAs) travel at a maximum speed of 10 km/h, usually do not have high acceleration and is equipped with intelligent braking. Therefore you have a low risk of injuring others.

Like in buying any insurance, please read the policy terms and conditions carefully. If you have doubts, clarify with the insurer. If you are purchasing a PA or already own a PA, check with your insurer if riding or using an e-scooter is one of the exclusions in their policy.

Finally, scoot safe, be gracious and have fun.